“Picture yourself in a boat on a river, with tangerine trees and marmalade skies…”

So, what does the famous first line from a famous Beatles’ song have to do with estate planning?

Actually, imagining a disembodied state is a good way to start planning what happens to your “estate,” a fancy word for your “stuff.” Picture yourself sort of floating above the craziness of life, as it slowly dawns on you that you’re not actually alive and taking part in all the chaos. You’re looking at all your loved ones, who are trying to carry on without you, doing their best to figure out what you wanted to do with all your stuff, not to mention who’s supposed to care for those who depend on you, like your kids or pets.

Preparing for the inevitable moment of death, while we’re still alive and well on Earth, able to consider and decide important things about our stuff, so that our loved ones don’t have to guess what we really wanted, that’s what I help people do. Not having a will can be even worse for those loved ones who actually KNOW what the deceased wanted but are helpless because it hadn’t been written out in a legally binding document.

Planning for death is uncomfortable for us: “I’m too young” (if you’re on your own, you’re not too young) or “I’m overwhelmed by the whole thing.” Don’t be. It’s really just a series of “what ifs”….. what if this happened, what would you want? What if that person you were counting on was gone too? It can be surprising how putting even the most basic estate plan in place can ease the load of those we love and care about most after we are gone.

Let’s look at some TV characters and see what would happen if they died in Georgia with no will, or an invalid will, versus what would happen if they made a valid will.

- Jerry Seinfeld – no wife, no kids, no will. We all know someone like him. If he were to die his parents would get everything. Can’t you just picture Elaine, George and Kramer, rolling their eyes…saying “WHAT?? Jerry wrote no will? He has no siblings, and his parents are all set down in Florida – they don’t need it, WE DO!” Maybe he wanted his parents to benefit, maybe he knew they were set and he wanted to share his success with his friends. But he can’t say now, because he’s floating around, wishing he hadn’t helped George’s fiancée with those cheap, toxic wedding invitations.

- Murphy Brown – TV anchor and single mom. Her out-of-wedlock son Avery would inherit everything, but who would be responsible for taking care of him if she died when he was just 6? The father of the boy is alive, but said from the get-go he doesn’t want to raise him, and doesn’t want to support him. Under the law, the biological dad would have the first claim to guardianship. He would likely also ask to be the custodian of the money Murphy left for Avery. Everyone would have to hope the dad didn’t squander the money before Avery reached age 18; if he did squander it, and had not posted a bond, there’s not much a court can do after the fact, and Avery may not want to sue his own dad. It’s his money, and his case.

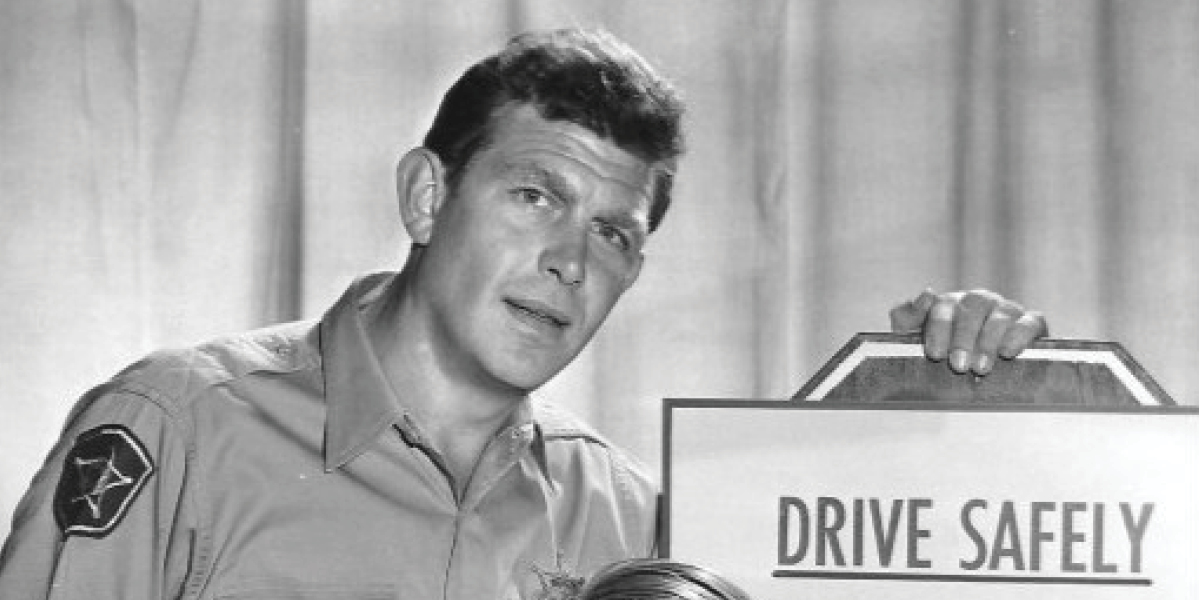

- Andy Griffith - What if dear old Andy died without a will and didn’t name Aunt Bea as Opie’s guardian? Courts today are rarely as homey and understanding as they once were …. the person able to give Opie the most financial security will probably win a contest for guardianship, since as best we know, Opie’s mom is no longer alive. Maybe it will be Aunt Bea, but maybe Opie’s mom had a brother… a busy rich guy from Mt. Pilot, or worse NYC, who Andy and Opie hadn’t seen or heard from in years. No amount of pleading from Bea and her friends will likely convince a court to let Opie stay in Mayberry, so we’re left imagining Andy as he hovers overhead, wailing, “No, no, I want Opie to stay with Aunt Bea!”

So how easy is it to make an estate plan? Much easier than you might think. Not to say it doesn’t take time, but the first thing to do is start floating overhead, looking at all your stuff: your assets, your debts, your family, and your relationships. You may not always be there to tell them what you’d like. Parenthood is a huge motivator to get these documents in order, but it’s not the only one. And it’s surprising how many make a will and then forget about it for 20 years. It’s never a bad idea to consider how things have changed, and consider the NEW “what ifs.”

So now, let’s figure out what Jerry, Murphy, and Andy might do differently to make life easier for their family and friends after they unexpectedly take their leave:

- Seinfeld – can make a very simple will giving most of his estate to his folks, but some to his pals (even George). That simple will stays in effect until Jerry marries or has a kid (even out of wedlock). Either of those events will void the will, and if he dies without making a new one, his wife and/or child will inherit his estate.

- Murphy – can create a will that leaves her entire estate in trust for Avery, identifying who she wants to administer the money for Avery’s benefit until he reaches a certain age (and it can go to him gradually). She can name that same person, or another person Avery knows and loves to be his caregiver until he reaches age 18. Then, assuming the biological dad doesn’t come back to stir up a fuss, Avery will be well-cared for by someone he knows and loves, with a trust fund to cover the costs.

- Andy – like Murphy, Andy can make a will and name a trustee to take care of Opie’s money until he’s old enough to manage it himself, and Andy can name Aunt Bea as Opie’s guardian, and a successor guardian if she gets too old or dies. That way any rich, absent, uncle who never had time for Opie won’t have to be in the picture.

As we imagine our own deaths (which is actually a very transcendental thing to do), we need to think about the ones we leave behind. We write these documents to help them deal with the harsh reality of life on earth after death.

Ann Grier is an accomplished, experienced lawyer here in Georgia who can help you consider all the “what ifs” so your spirit won’t be left to float overhead, searching high and low for Whoopie Goldberg to be the medium to tell your loved ones what you meant to tell them yesterday….when all your troubles seemed so far away.

These are general observations and ideas, not legal advice. Every case is unique and requires specific analysis by a reputable, competent estate planning attorney licensed to practice in your state of residence.

Please call Ann Grier (404) 692-8555 to discuss your specific Georgia matter.